Homo economicus or Homo abyssimus

“…not only have economists, as a profession, failed to guide the world out of the crisis, they were also primarily responsible for leading us into it...The scandal of modern economics is that these two false theories—rational expectations and the efficient market hypothesis—which are not only misleading but highly ideological, have become so dominant in academia (especially business schools), government and markets themselves...Economics today is a discipline that must either die or undergo a paradigm shift.“

Black Swan Economics

An economic revolution is gaining steam, if we listen to some quarters of the intellectual blogosphere today. For those who haven’t caught the latest trend, Nassim Taleb (economist and author of The Black Swan and The Bed of Procrustes: Philosophical and Practical Aphorisms) has been making the talk tv rounds lately, pumping up the Republican presidential hopeful Ron Paul. Why? In short, Ron Paul is talking economic sanity, Taleb argues, while everyone else–including most of those in power in Washington–are talking dangerous economic nonsense. For example, Taleb wrote in a 2010 article titled Why Did the Crisis of 2008 Happen:

“As we saw with banks, Toyota’s problem, the BP oil spill, an economic system with a severe agency problem builds a natural tendency to push and hide risks in the tails, even without help from the economics establishment. Risks keep growing where they can be seen the least; there is a need to break the moral hazard by making everyone accountable both chronologically and statistically.

Hence the principle: The captain goes down with the ship; all captains and all ships: making

everyone involved in risk-bearing accountable, no exception, not a single one. Morally, legally, whatever can be done. That includes the “Nobel” committee (Bank of Sweden), the academic establishment, the rating agencies, forecasters, bank managers, etc. Time to realize that capitalism is not about free options.“

For those unfamiliar–which would have included myself until very recently (thanks extra dissertation reading!), the reference by Taleb to the “Nobel” committee is a reference to modern portfolio theory (or MPT), a finance theory dealing with equity investing, assets, risk and portfolio diversification. The theory was originally developed in 1952 by economist Harry Markowitz in a paper entitled Portfolio Selection published in the Journal of Finance (7:1 1952. pp. 77-9). Markowitz was a student of the Hungarian born economist John von Neumann, a major scientific figure in the first half of the 20th century, known for his work on quantum mechanics, linear systems and set theory. Those in the social science may know him as the father of game theory, made famous in his 1944 book Theory of Games and Economic Behavior with Oskar Morgenstern. When Markowitz wrote this he was studying economics as the University of Chicago, and the Chicago economics influence is clearly visible in his laissez-faire and perfectly informed rational economic actor models. And incidentally, he has a creepy resemblance to one of his mentors, Milton Friedman (see above).

For those unfamiliar–which would have included myself until very recently (thanks extra dissertation reading!), the reference by Taleb to the “Nobel” committee is a reference to modern portfolio theory (or MPT), a finance theory dealing with equity investing, assets, risk and portfolio diversification. The theory was originally developed in 1952 by economist Harry Markowitz in a paper entitled Portfolio Selection published in the Journal of Finance (7:1 1952. pp. 77-9). Markowitz was a student of the Hungarian born economist John von Neumann, a major scientific figure in the first half of the 20th century, known for his work on quantum mechanics, linear systems and set theory. Those in the social science may know him as the father of game theory, made famous in his 1944 book Theory of Games and Economic Behavior with Oskar Morgenstern. When Markowitz wrote this he was studying economics as the University of Chicago, and the Chicago economics influence is clearly visible in his laissez-faire and perfectly informed rational economic actor models. And incidentally, he has a creepy resemblance to one of his mentors, Milton Friedman (see above).

All of these debates in some form or another go back to a much earlier, and now returning debate, about the basic assumption of human nature–that we are rational beings who act on our preferences and always seek to maximize our utility while avoiding risk. Sound familiar? It should, as it forms the basis of Western Liberalism (actual classical Liberalism, not the arbitrary liberal/conservative divisions we know today), Enlightenment rationality and the rise of modern science, mathematics and economics (esp. the classical laissez-faire version). In short, it’s about two central beliefs of modern, parasitic, high finance capitalism–rationality and efficiency.

This debate has a long history, which I won’t go into here, but which you can read more about here and here. As Anatole Kaletsky wrote in 2009 in her article, Goodbye, Homo Economicus:

“Was Adam Smith an economist? Was Keynes, Ricardo or Schumpeter? By the standards of today’s academic economists, the answer is no. Smith, Ricardo and Keynes produced no mathematical models. Their work lacked the “analytical rigour” and precise deductive logic demanded by modern economics. And none of them ever produced an econometric forecast (although Keynes and Schumpeter were able mathematicians). If any of these giants of economics applied for a university job today, they would be rejected. As for their written work, it would not have a chance of acceptance in the Economic Journal or American Economic Review. The editors, if they felt charitable, might advise Smith and Keynes to try a journal of history or sociology.”

If we take the route of someone like Taleb and ask a more pointed political question–such as what values inform the logic of freakonomics and the rational actor models of science more generally–we quickly find we are up against a massive machine with absolutely no interest in critical self-reflection. As Nassim argued recently, part of the contemporary social crisis (in the US and elsewhere) has to do with the political assumptions produced by certain economic models, as he explained in a recent CNBC interview.

For a little more detail on Taleb’s critique, I suggest watching his interview from last year with Charlie Rose, where he talks about economics and politics.

But before I end this post, I want to return to one of the points I started with, namely, Taleb’s support for Ron Paul and the claim that Paul is talking smart economics. So, is he? To make sense of what Ron Paul is proposing, let’s take a look at his official plan: Plan to Restore America. Here’s a few things the plan includes:

- cut $1 trillion in spending during the first year

- eliminate 5 cabinet-level departments (Energy, HUD, Commerce, Interior, Education)

- abolish the Transportation Security Administration (TSA)

- abolish corporate subsidies

- return most other spending to 2006 levels

- 10% reduction in the federal workforce

- lower the corporate tax rate to 15%

- extend all Bush tax cuts

- abolish the Estate Tax (what Conservatives call the “Death Tax”)

- end taxes on personal savings

It’s not too hard to see that some of these ideas have nothing to do with smart economics–for example eliminating the Departments of the Interior or Education, extending Bush tax cuts or ending the estate tax–all of those simply serve big business interests and private corporations antsy to get their paws on these currently public areas of policy.

As an example, under current IRS law, any transfer of property after someone dies can occur without any federal estate tax if the value of the property is under $5 million for a single individual, or $10 million for couples. So to suggest that repealing the estate tax will help America, much less the average citizen, is simply ridiculous and speaks to the elitist world that Ron Paul and others like him perpetuate under the rubric of “populist” politics.

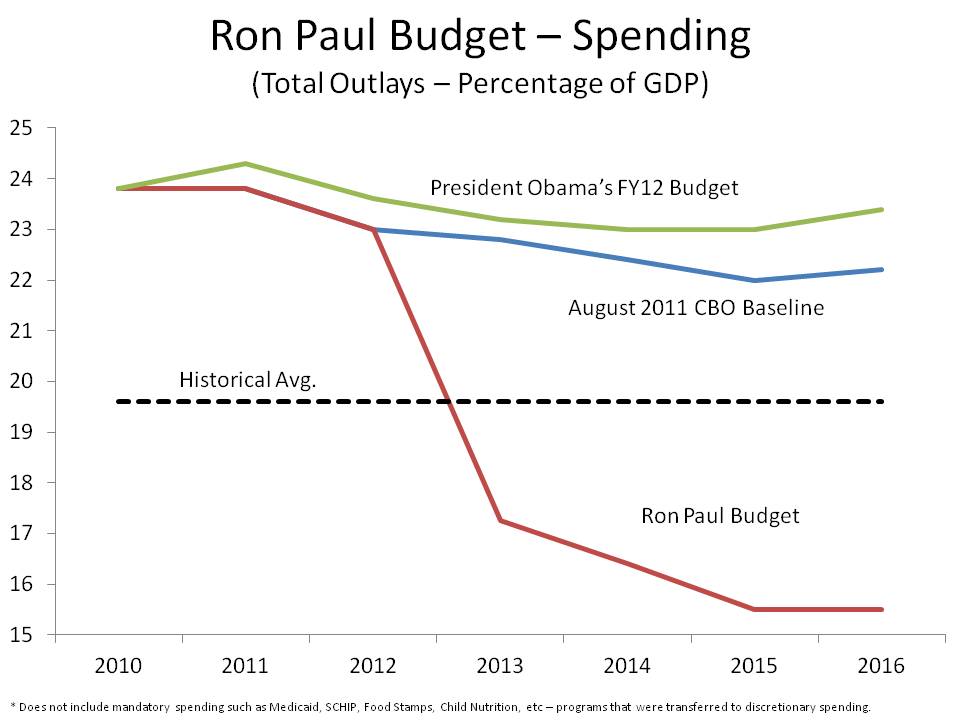

Here’s an example provided from the Plan showing how Paul thinks his proposal stacks up by comparison.

So although this has not been a serious investigation into the economic policies of Paul, from even a cursory reading it is clear that he is way out of touch with many of the economic realities of most of us living in the US today. As far as I can tell, the only substantive reason Nassim Taleb has been beating the bush for Paul is because he wants to cut back on spending and reduce the debt and deficit, all smart policies that none of the other candidates are proposing in reality, and which Talen also agrees on. But if this is what constitutes a “radical economic solution” for America, well, it’s pretty clear that we’re all screwed!

Until next time…space invaders are beyond the law of possibilities.

###